High Level Data Security

We employ bank-grade data encryption (AES-256-CBC) to secure your financial information, ensuring our website is extremely safe for you to use without concern.

We maintain strict confidentiality by never selling, renting, leasing, or sharing your data with any third party. Because we understand that personal financial details are sensitive and vulnerable to fraud and scams, our robust security measures and privacy policy are designed specifically to protect you from such risks.

Inflation-Adjusted Projections

Get accurate future value calculations for all cash flows adjusted for inflation with our proprietary InnFinn returns formula.

Salary expense projections

Investment return calculations

IRR and XIRR adjustments

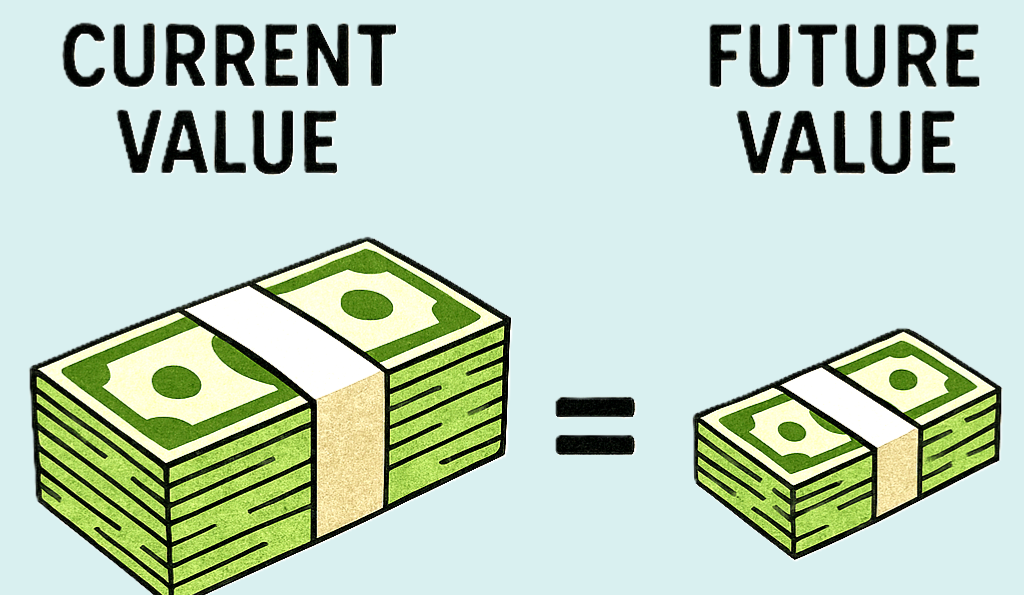

Inflation-Adjusted Returns

Inflation can eat away your profit thus reducing the actual return earned from the investment, thus, making the investor have a false sense of security. Through our website you may know the inflation adjusted return on your investments thus providing a more accurate condition of your portfolio. An investment with a cash inflow many years after the investment would in reality provide a considerably less return if the cash flow is adjusted for inflation.

Financial Predictions

Get AI-powered forecasts of your financial future based on current trends and habits.

Cash flow projections

Savings potential

Goal tracking

Investment Tracking

Monitor all investments in one place with performance analytics and growth projections.

Portfolio visualization

Return analysis

Asset allocation

Expense Management

Track spending patterns and identify savings opportunities with smart categorization.

Custom categories

Spending alerts

Budget tracking

Income Tracking

Track all income sources with automatic salary tracking and visualization of growth trends.

Multiple income streams

Automatic categorization

- Growth trends analysis